NBAD Bank Balance Check Salary Card – Checking your salary card balance with NBAD, now part of First Abu Dhabi Bank (FAB), may sound like a simple task, but there’s more to it than just logging in and checking your funds.

It’s all about convenience, security, and understanding the system, especially for those using salary or prepaid cards, like the Ratibi card, which is commonly used for payroll in the UAE.

First, let’s talk about the background. NBAD merged with FAB back in 2017, which means that any NBAD-branded services, including salary cards, are now handled under the FAB umbrella. The functionality remains similar, but knowing this transition is key when searching for support or instructions

Now, getting to the heart of the matter—checking your balance. FAB offers a range of methods to do this, each tailored to meet the needs of different types of users. Some may prefer a more digital approach, while others may feel more comfortable using physical methods.

1. Using the FAB Mobile App

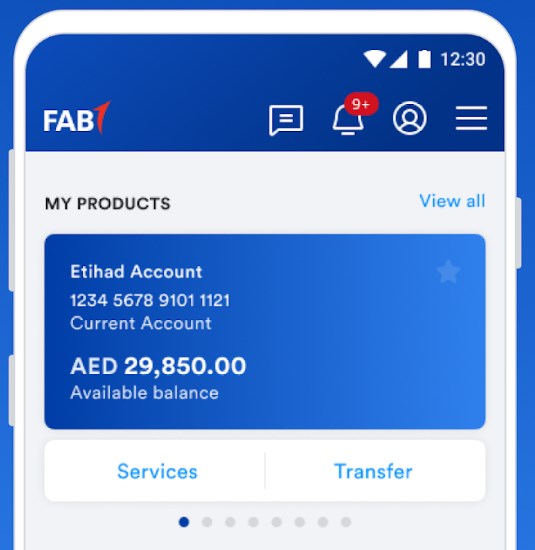

One of the easiest and most convenient ways to check your balance is through the FAB mobile app. If you haven’t already, downloading the app should be your first step. Once installed, you’ll need to log in using your card details.

For first-time users, you’ll have to go through a registration process that includes providing your card number, mobile number, and creating a secure login PIN.

Once you’re in, the app will display your balance front and center, along with transaction history and other financial information. It’s as easy as opening the app and getting a quick overview

2. Via FAB’s Website (Prepaid Card Inquiry)

Another popular option is using the FAB website, where you can enter your card details and immediately get your balance. All you need is your card ID and the last two digits of your card number. This method is straightforward, and what’s nice about it is the real-time access without needing to install an app

3. At ATMs

Prefer a more traditional approach? ATMs are still a great option. Any FAB ATM will allow you to check your balance. Just insert your card, enter your PIN, and select the “Balance Inquiry” option. While it’s convenient, it’s worth noting that some ATMs may charge a small fee for balance inquiries, depending on the card type and location

4. Customer Service

If you’re someone who prefers human interaction, FAB’s customer service is also available. You can call their hotline, provide your card information, and they’ll help you check your balance. Keep in mind that this method might involve a wait time, and as with ATMs, there may be fees associated with certain inquiries

5. Visiting a Branch

For those who prefer an in-person approach, visiting a FAB branch is an option. While this may seem a bit outdated compared to other methods, it’s useful if you’re already in the bank for other matters, and you can get personalized assistance if needed

Managing Your Balance Wisely

Beyond simply checking your balance, managing your salary card effectively is also important. FAB offers tools like balance alerts through SMS or email, which notify you when your balance reaches a certain threshold. This feature is particularly useful for avoiding overdrafts or managing spending(

Conclusion

In conclusion, whether you’re using the FAB app for quick access or preferring the familiarity of an ATM, keeping track of your salary card balance is simpler than ever. Just be mindful of potential fees associated with certain methods, and leverage the digital tools available for maximum convenience and efficiency. Balancing between technology and personal preference is key when managing your finances today!